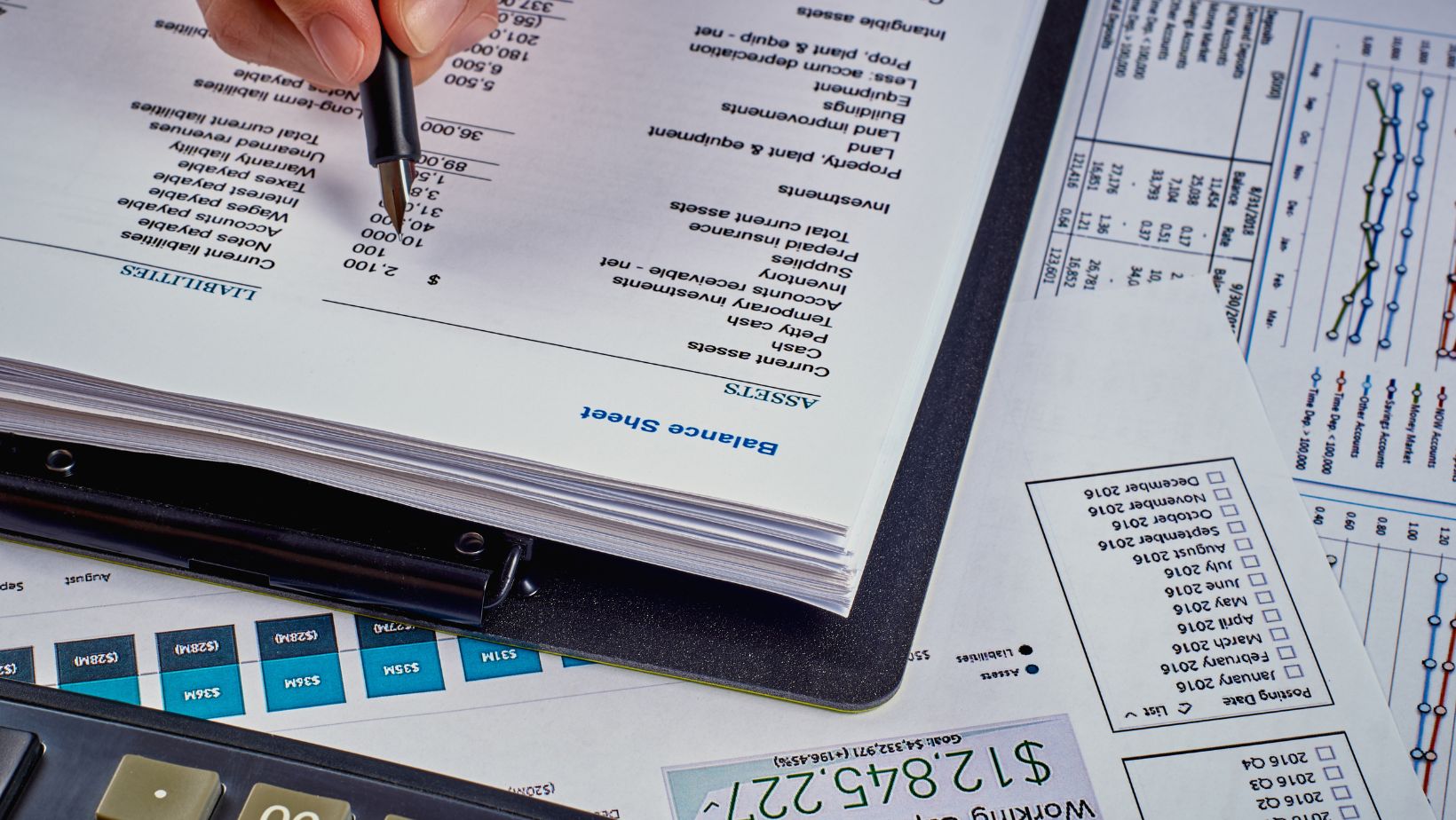

When it comes to managing finances and tracking the financial health of a business, having the right tools in place is crucial. That’s where balance sheet software comes into play. As a seasoned expert in the financial industry, I understand the importance of accurate and efficient financial reporting. In this article, I’ll delve into the world of balance sheet software, exploring its benefits, features, and why it is a must-have for businesses of all sizes. With the evolution of technology, traditional methods of balancing financial statements have given way to more sophisticated and user-friendly software solutions. As I guide you through the intricacies of balance sheet software, you’ll discover how these tools can streamline your financial processes, provide real-time insights, and ultimately empower you to make informed business decisions.

Balance Sheet Software

When it comes to balance sheet software, it plays a crucial role in efficiently managing finances and monitoring the financial well-being of a business. These leading balance sheet software providers offer comprehensive solutions to streamline financial processes and enhance decision-making capabilities. Consider the specific needs of your organization to choose the most suitable software provider for efficient balance sheet management. Here’s a closer look at the benefits for accountants and the significant impact it has on financial reporting:

Benefits for Accountants

- Improved Accuracy: With balance sheet software, accountants can ensure precise calculations and reduce the risk of errors in financial statements.

- Time Efficiency: This software streamlines accounting processes, saving accountants valuable time that can be redirected to more strategic tasks.

- Real-Time Updates: Accountants can access up-to-date financial data instantly, providing them with the most current information for decision-making.

Key Features to Look for in Balance Sheet Software

When considering balance sheet software, two key features are paramount: real-time data processing and integration with other financial systems. These features play a crucial role in enhancing financial management processes and ensuring streamlined operations.

Real-Time Data Processing

In the realm of balance sheet software, real-time data processing is a game-changer. It allows for instant updates and insights into the financial status of a business. With real-time processing capabilities, I can access up-to-the-minute data, enabling me to make informed decisions promptly. This feature ensures that financial information is always current and accurate, resulting in improved operational efficiency.

Integration with Other Financial Systems

Another essential feature to look for in balance sheet software is seamless integration with other financial systems. This functionality enables me to consolidate data from various sources effortlessly. By integrating with accounting, ERP, and other financial platforms, the software ensures data consistency and eliminates the need for manual data entry. This streamlines processes, reduces errors, and provides a holistic view of the organization’s financial landscape.

Leading Balance Sheet Software Providers

When considering balance sheet software providers, it’s essential to assess the range of features and functionalities offered. Here are some top providers known for their reliable solutions:

Software Comparison

- QuickBooks Online: QuickBooks Online is a widely used accounting software that offers robust balance sheet management features. It provides real-time data updates and seamless integration with other financial tools.

- Xero: Xero is another popular choice known for its user-friendly interface and comprehensive financial reporting capabilities. It allows for efficient balance sheet creation and monitoring.

- NetSuite: NetSuite offers advanced cloud-based accounting solutions with a focus on automation and scalability. Its balance sheet module provides detailed insights for strategic decision-making.

How to Successfully Implement Balance Sheet Software

After exploring the benefits and features of balance sheet software, it’s clear that choosing the right provider is crucial for efficient financial management. By selecting a software solution like QuickBooks Online, Xero, NetSuite, or Sage Intacct, organizations can streamline their balance sheet processes and gain valuable insights for strategic decision-making. Implementing these tools can lead to reduced reporting time, improved data visibility, enhanced operational efficiency, and customized analytics tailored to specific business needs. It’s essential for companies to assess their requirements and select a software provider that aligns with their goals to maximize the benefits of balance sheet software. By leveraging these tools effectively, businesses can achieve greater financial transparency and control.