Are you tired of outdated budgeting tools that just don’t cut it anymore? Imagine having a budgeting solution that adapts to your financial needs in real-time. That’s where adaptive budget software comes in. With its dynamic capabilities, it revolutionizes the way you manage your finances. I’ve delved into the world of adaptive budget software to uncover its benefits and how it can transform your budgeting experience. From personalized insights to automated adjustments, this software takes the guesswork out of financial planning. Join me as we explore the power of adaptive budget software and how it can help you achieve your financial goals effortlessly.

Adaptive Budget Software

Adaptive budget software is a cutting-edge financial tool that dynamically adjusts budget allocations based on changing circumstances. It leverages advanced algorithms to analyze spending patterns, income fluctuations, and financial goals in real-time, ensuring optimal financial management. With real-time adjustments, personalized recommendations, and automation features, it revolutionizes the way we handle budgets.

- Real-time Adjustments: Adaptive budget software allows for instant modifications to budget allocations, enabling users to adapt to unforeseen expenses or income changes promptly.

- Personalized Insights: By examining individual financial data, this software provides personalized recommendations for optimizing budget strategies to achieve specific financial objectives.

- Automation: One of the standout features is its automation capabilities, which streamline budgeting processes and reduce manual effort, leading to more efficient financial management.

- Goal Achievement: With its tailored approach and data-driven recommendations, adaptive budget software enhances users’ ability to reach their financial goals efficiently.

- Forecasting: The software utilizes forecasting tools to predict future financial trends, empowering users to make informed decisions and stay ahead of financial challenges.

- Scalability: Whether for personal finance or business budgeting, adaptive budget software scales to meet diverse needs, offering flexibility and precision in financial planning.

- Enhanced Accuracy: By analyzing data in real-time and adjusting budget allocations accordingly, the software ensures greater accuracy in financial planning and decision-making.

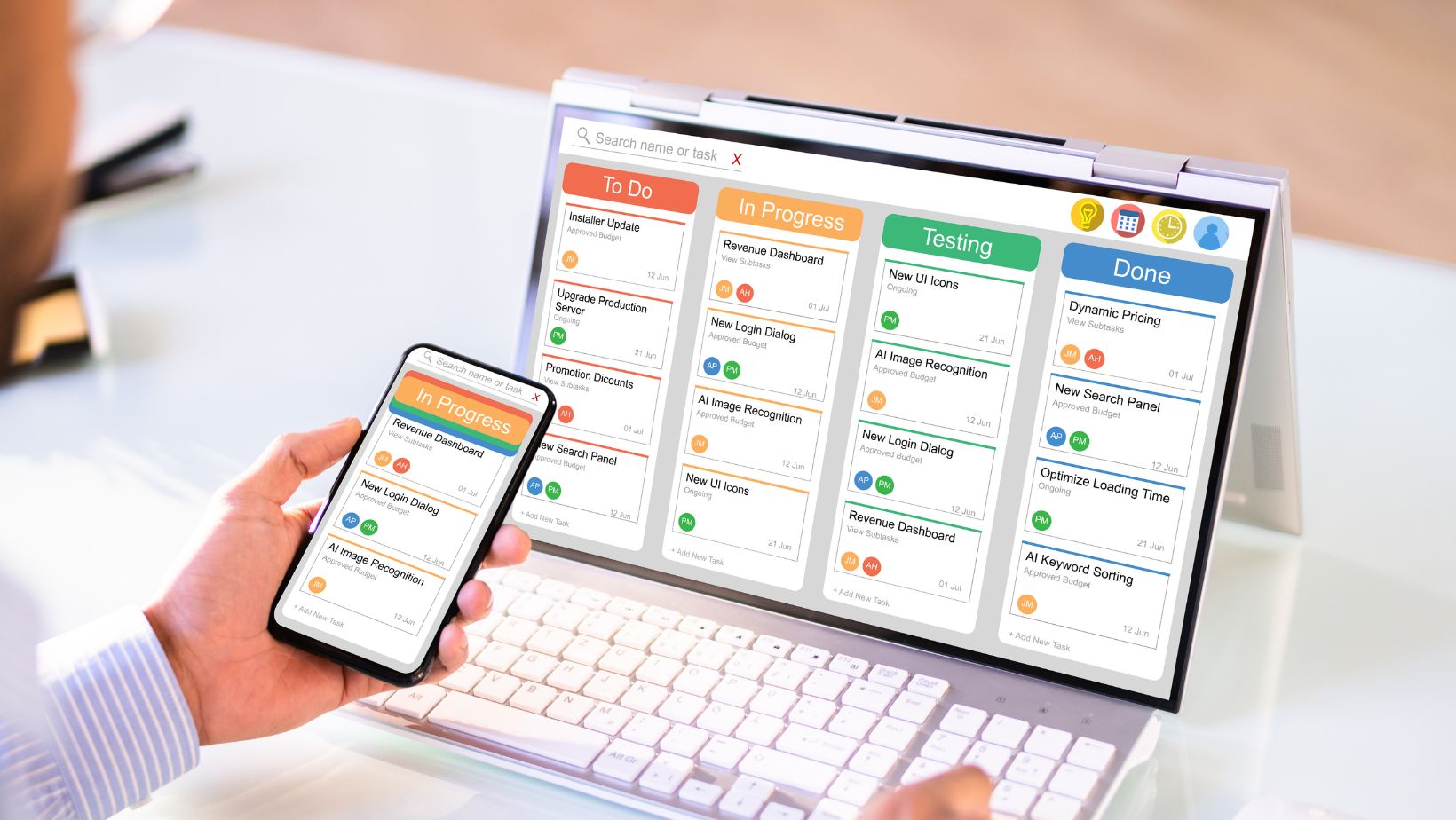

- Budget Tracking: Users can track expenses, monitor budget adherence, and receive alerts for potential budget overruns, facilitating proactive financial management.

- User-Friendly Interface: Designed for ease of use, adaptive budget software features intuitive interfaces that simplify the budgeting process for users of all levels of financial expertise.

- Security Measures: With advanced data encryption and secure cloud storage, users can trust that their financial information is protected and confidential while using adaptive budget software.

How Adaptive Budget Software Enhances Financial Planning

Adaptive budget software revolutionizes financial planning by offering dynamic features that enhance traditional budgeting tools. With real-time adjustments and improved forecasting accuracy, this software provides personalized insights and automation for efficient financial management tailored to individual needs. The software’s forecasting tools and scalability for personal and business finance make it a versatile solution for various needs. By enhancing accuracy in financial planning and providing user-friendly interfaces, it ensures efficient budget tracking and secure management.

Real-Time Budget Adjustments

I analyze user data and financial trends in real-time, allowing me to make instant adjustments to budgets. This feature ensures that financial plans are always up-to-date, reflecting current spending patterns and changes in income. By instantly adapting to fluctuations, I can optimize my budget allocation for better financial control.

Improved Forecasting Accuracy

With advanced algorithms and data analytics, I leverage improved forecasting accuracy to predict future financial outcomes. This capability enables me to make informed decisions based on reliable projections, helping me set realistic financial goals and track progress effectively. By enhancing forecasting accuracy, I can anticipate financial challenges and plan proactively for financial success.With its tailored approach and data-driven recommendations, adaptive budget software enhances users’ ability to reach their financial goals efficiently.

Implementing Adaptive Budget Software

After exploring the dynamic capabilities and personalized insights of adaptive budget software, it’s clear that this innovative tool is a game-changer in financial management. With real-time adjustments, personalized recommendations, and automation features, it revolutionizes the way we handle budgets. The software’s forecasting tools and scalability for personal and business finance make it a versatile solution for various needs. By enhancing accuracy in financial planning and providing user-friendly interfaces, it ensures efficient budget tracking and secure management. The advanced algorithms and data analytics driving improved forecasting accuracy empower informed decision-making and realistic goal setting. Selecting adaptive budget software involves considering factors like real-time adjustments, customization, automation, scalability, and security measures. Options like Adaptive Insights, Oracle NetSuite Planning and Budgeting, Planful, Prophix, and Budget Maestro offer a range of features to meet diverse financial management requirements effectively.